Starlink’s Entry into Kenya Sparks Competition, Safaricom Seeks Regulatory Intervention

Starlink's entry into the Kenyan market with a low-cost data plan has intensified competition, challenging Safaricom and Airtel. Offering 50GB for Ksh1,300, Starlink's pricing is significantly lower than local providers, though it requires a costly installation. Safaricom has responded by appealing to the Communications Authority of Kenya to regulate Starlink, sparking debates on fair competition in Kenya's free-market economy. This development highlights the potential for affordable internet to lower business costs and increase consumer disposable income.

Starlink, Elon Musk’s satellite internet provider, has shaken up the Kenyan market by launching a new, more affordable data plan, threatening the dominance of local giants Safaricom and Airtel. Starlink’s new package offers 50GB of monthly data for just Ksh1,300 ($10.16), significantly undercutting Airtel’s similar package priced at Ksh3,000 ($23.44) and Safaricom’s 45GB package at Ksh2,500 ($19.53).

Despite the attractive pricing, Starlink’s service comes with a substantial upfront cost of Ksh45,500 ($355.47) for installation hardware, a stark contrast to the SIM card activation model used by local telcos.

In addition to its competitive pricing, Starlink has made payments convenient for its users by integrating mobile money options like M-Pesa and Airtel Money. This move is expected to intensify competition in the Kenyan data market, where Safaricom currently holds a dominant 63.7% share, followed by Airtel at 31.5%, according to the Communications Authority of Kenya (CA).

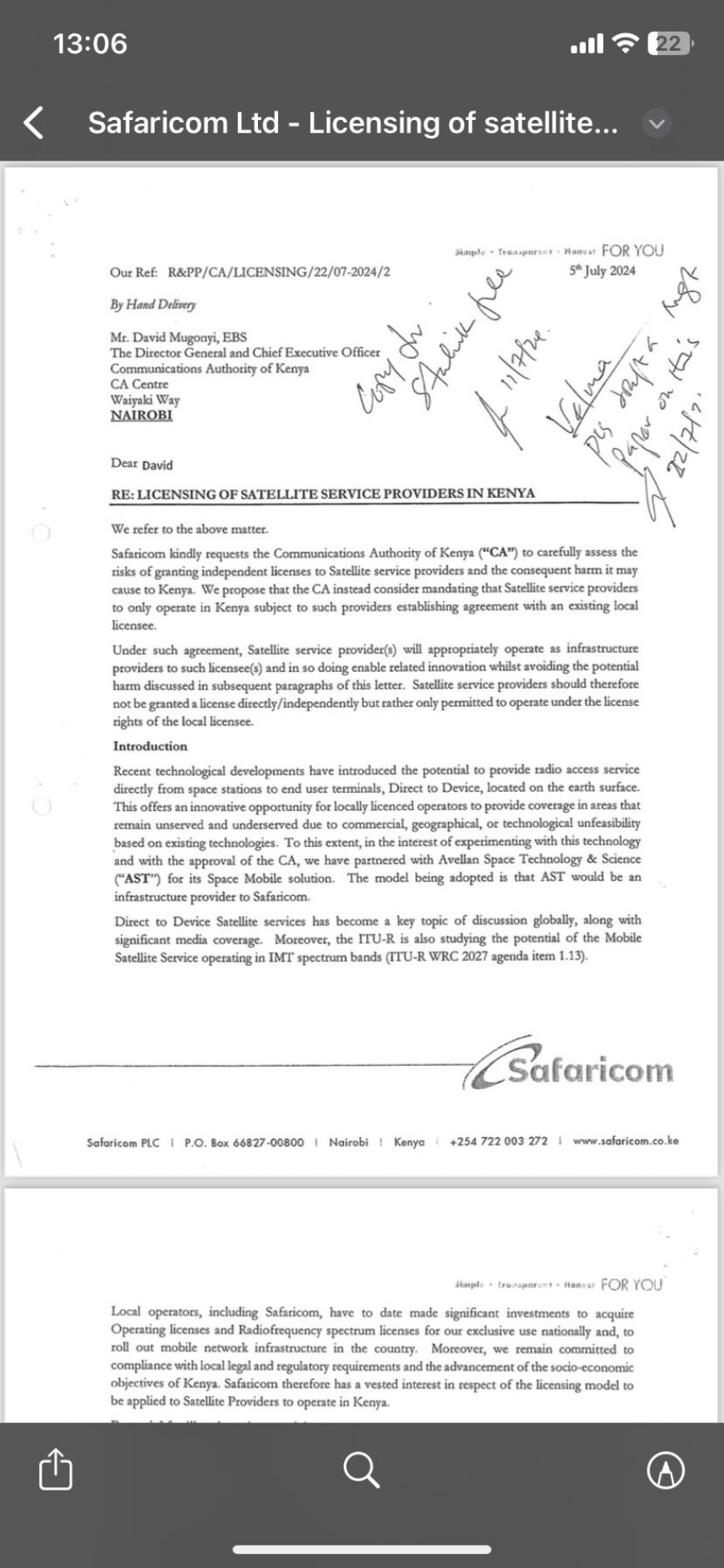

However, Safaricom appears to be feeling the heat from Starlink’s entry and has reportedly written to the CA, requesting the regulator to impose restrictions on Starlink’s operations in Kenya. This move raises critical questions about fair competition and market dynamics.

One must ask Safaricom’s management: Did Telkom Kenya, which was the incumbent provider during the late 1990s, attempt to block Safaricom’s entry into the market when mobile technology was still in its infancy in Kenya? Safaricom, which thrived in a competitive environment, should understand that Kenya operates under a free-market economy. Here, consumers drive market trends, including pricing, and determine the success or failure of service providers.

All businesses need to recognize that erecting barriers to market entry only stifles innovation and consumer choice. Access to affordable internet and data services is crucial for lowering business costs, which benefits both enterprises and households by increasing disposable income. Safaricom’s appeal to the regulator to limit competition is not only unethical but could also undermine the principles of a free and fair market, which has been the foundation of Kenya’s economic growth.

What's Your Reaction?