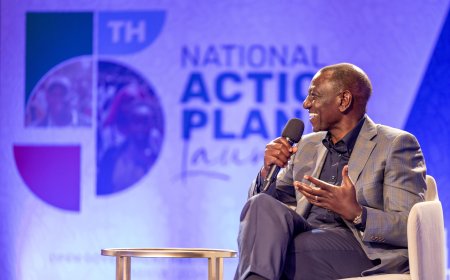

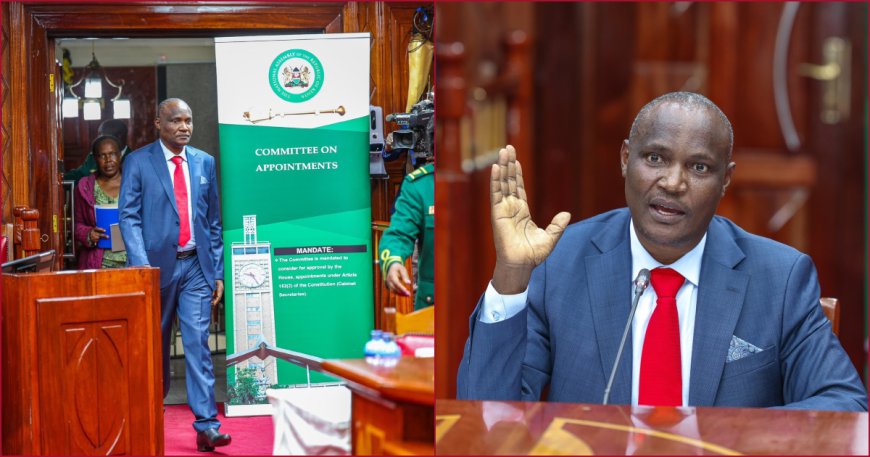

Treasury CS John Mbadi Meets KRA Commissioner General, Hints at New Tax Measures

"Treasury CS John Mbadi meets with KRA Commissioner General to discuss new tax measures and reforms aimed at boosting Kenya's revenue collection, including the reintroduction of the Eco Levy." "CS John Mbadi discusses new tax measures with KRA, focusing on revenue collection and the reintroduction of the Eco Levy to enhance Kenya's economic growth."

Newly appointed National Treasury Cabinet Secretary (CS) John Mbadi this morning a crucial meeting with the leadership team of the Kenya Revenue Authority (KRA), including Commissioner General Humphrey Wattanga. The meeting underscores the government's dedication to enhancing revenue collection and improving financial management to spur Kenya's economic growth.

Focus on Tax Reforms

In a statement shared by the National Treasury on its X handle, Mbadi emphasized the importance of the now-defunct Finance Bill 2024, which included several tax provisions aimed at steering the country toward economic recovery and growth. Although the bill cannot be revived in its entirety, Mbadi noted that some of its tax-exempt measures could still play a key role in reducing tax expenditures. He highlighted that tax refunds on items zero-rated from 16% VAT primarily benefit business owners and companies rather than ordinary citizens. Additionally, Mbadi expressed support for extending the tax amnesty program, which he believes is crucial for boosting revenue collection.

Reintroduction of the Eco Levy

Mbadi also announced plans to reintroduce the Eco Levy, originally proposed in the Finance Bill 2024, with amendments focused on addressing pollution without overburdening ordinary citizens. The Eco Levy is an environmental tax targeting manufacturers and importers of specific products. The funds raised would be used to establish waste management infrastructure, support Kenya's sustainable waste management program, and set up material recovery facilities and electronics waste collection centers across the country's 47 counties. The government aims to generate KSh 150 billion in tax revenue through these tax changes.

Furthermore, Mbadi hinted at significant reforms within the Kenya Revenue Authority (KRA) to tackle tax evasion and increase revenue collection by up to KSh 400 billion. These reforms are expected to strengthen the government's ability to fund essential services and support economic development.

What's Your Reaction?