“Banking on Change: Australia’s Largest Bank Cuts Ties with Fossil Fuels”

The Commonwealth Bank of Australia has announced it will stop financing fossil fuel companies that do not align with the Paris Agreement’s climate goals by the end of 2024. This article explores the implications of this decision, the challenges ahead, and the potential impact on the financial industry and global climate efforts.

In a landmark decision, the Commonwealth Bank of Australia (CBA), the nation’s largest lender, has announced it will cease financing fossil fuel companies that fail to align with the Paris Agreement’s climate goals by the end of 2024. This bold move marks a significant shift in the bank’s approach to environmental responsibility and sets a new standard for the financial industry.

For years, CBA has been under scrutiny for its substantial investments in coal, oil, and gas projects. Environmental groups have long criticized the bank for contributing to climate change by funding fossil fuel extraction and production. However, the latest announcement signals a dramatic change in direction. CBA has committed to stopping new corporate or trade finance, as well as bond facilitation, for clients who do not meet stringent emissions reduction criteria.

The bank’s new policy requires clients to have a medium-term emissions reduction plan for 2035 and a net-zero ambition covering at least 95% of their carbon pollution from processing and extraction. This move is part of a broader strategy to reduce the bank’s exposure to fossil fuels and support the transition to a low-carbon economy.

Market Forces, a climate lobby group, has praised CBA’s decision, calling it a “crystal clear message” to the fossil fuel industry. The group highlighted that CBA’s exposure to fossil fuel extraction was already relatively low, at just 0.2% of its total outstanding loans. This proactive stance is expected to put pressure on other major Australian banks to follow suit.

Despite the positive reception from environmental advocates, the decision has not been without controversy. Critics argue that the move could impact the bank’s profitability and limit financing options for energy companies during a critical period of transition. However, CBA’s leadership remains steadfast in their commitment to sustainability.

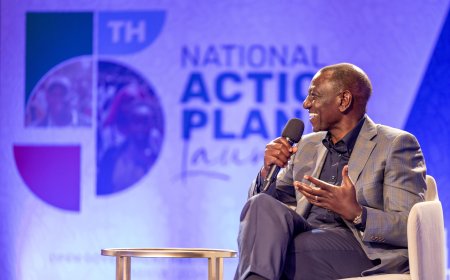

Matt Comyn, CEO of CBA, stated, “We recognize the urgent need to address climate change and are committed to playing our part in the transition to a sustainable future. This decision reflects our belief that long-term financial stability and environmental responsibility go hand in hand.”

The implications of CBA’s decision extend beyond the financial sector. By cutting ties with fossil fuel companies, the bank is sending a powerful message about the importance of aligning business practices with global climate goals. This move is likely to influence other industries and encourage greater investment in renewable energy and sustainable technologies.

The transition away from fossil fuels is not without challenges. Renewable energy sources like wind and solar are becoming more viable, but the energy grid still relies heavily on fossil fuels for periods of peak demand. Balancing the need for reliable energy with the imperative to reduce carbon emissions will require innovative solutions and collaborative efforts from both the public and private sectors.

As the world grapples with the impacts of climate change, CBA’s decision represents a significant step towards a more sustainable future. By prioritizing environmental responsibility, the bank is not only protecting its financial interests but also contributing to the global effort to combat climate change.

In conclusion, the Commonwealth Bank of Australia’s decision to stop financing fossil fuel companies that do not comply with the Paris Agreement’s climate goals is a groundbreaking move. It sets a new standard for the financial industry and underscores the importance of aligning business practices with environmental sustainability. As other banks and industries take note, this could mark the beginning of a broader shift towards a greener, more sustainable economy.

What's Your Reaction?