The Dark Side of Quick Money: Understanding the Rise of Shady Financial and Land Deals in Kenya

This article delves into the alarming rise of fraudulent financial and land schemes in Kenya, highlighting the common tactics used by scammers and the reasons why so many fall victim. It discusses the influence of social media influencers in promoting these scams, the driving factors behind both the perpetrators and victims, and provides practical advice on how to avoid being duped. The article emphasizes the importance of due diligence, regulatory verification, and seeking professional financial and legal advice before making any investment. Explore the surge of shady financial and land deals in Kenya, where thousands have been conned by promises of quick, astronomical returns. This article examines the common characteristics of these scams, the role of social media influencers in promoting them, and the factors that make individuals vulnerable. It also offers guidance on how to protect yourself from falling prey to such fraudulent schemes.

In recent years, Kenya has witnessed a disturbing surge in fraudulent financial and land schemes, leaving countless hardworking citizens devastated and financially crippled. From botched pyramid schemes to dubious land deals, the allure of quick, high returns has ensnared many. The question remains: what drives individuals to create these schemes, and why do so many fall victim to them?

The common thread among these schemes is their too-good-to-be-true promises. Whether it's through purportedly lucrative forex trading platforms, high-yield investment portfolios, or cheap land deals, these schemes share several characteristics:

Astronomical Promises

Many of these scams promise unbelievably high returns, sometimes as high as 20% per week or month. Such rates are not only unrealistic but also unsustainable in the legitimate financial world. These schemes play on the greed of investors, offering them a chance at wealth that conventional investments cannot match.

Minimal Upfront Investment

Another hallmark of these scams is the low entry cost. Whether it's a deposit for land or a down payment for a motorbike, the amounts are often much lower than those required by legitimate financial institutions. This makes the deal appear accessible to a wider audience, including low-income earners who see it as a rare opportunity to improve their financial standing.

Lack of Regulatory Oversight

These schemes typically operate outside the bounds of regulatory oversight. They often bypass the Capital Markets Authority (CMA) and other regulatory bodies, avoiding the checks and balances that would reveal their fraudulent nature. Additionally, they rarely involve financial or legal professionals, instead relying on their own skewed advice.

Briefcase Companies

Many of these schemes are run through "briefcase companies"—businesses that exist in name only, with no physical office or legitimate business operations. These companies are set up to disappear as quickly as they are formed, leaving no trace once the scam is exposed.

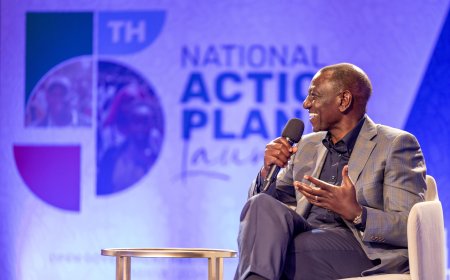

The Influence of Social Media and Pop Culture

In the digital age, the rise of social media influencers has added a new dimension to these scams. Influencers, who often have large followings, are increasingly becoming the faces of these fraudulent schemes. They leverage their credibility and reach to market these scams to unsuspecting followers.

For instance, a recent case involved a well-known HIV rights activist in Kenya who allegedly lured her followers into a botched investment scheme. Similarly, a preacher in Eldoret convinced his congregants to invest in a fraudulent forex trading platform. The involvement of these public figures adds a veneer of legitimacy to the schemes, making it easier to dupe the masses.

However, it’s crucial to understand that influencers are not financial experts. Their primary role is marketing, not providing sound financial advice. Relying on their endorsements rather than professional financial and legal advice is a recipe for disaster.

Why Do People Fall for These Scams?

The primary reason people fall for these scams is the desire for quick money. In an economy where opportunities for rapid wealth accumulation are scarce, the promise of quick returns is incredibly tempting. For many, especially those struggling financially, these schemes appear to be a golden opportunity to escape poverty.

Moreover, there is a lack of financial literacy among many Kenyans. The average person may not fully understand the complexities of investment or the red flags that signal a fraudulent scheme. This lack of knowledge, combined with the desire for quick riches, makes people easy targets for scammers.

To avoid falling victim to these schemes, potential investors must take several precautions:

Regulatory Verification

Ensure that any investment firm you deal with is legally registered and regulated by the Capital Markets Authority (CMA). Legitimate investment firms will have the necessary documentation and will be transparent about their operations.

Professional Advice

Before investing, consult with financial consultants, investment bankers, and legal experts. They can provide an unbiased analysis of the investment, helping you understand the risks involved and whether the promised returns are realistic.

Due Diligence

Perform thorough background checks on the company and the investment. For land deals, this includes checking the history of the land, ensuring the seller has the right to sell, and confirming that the land is free from disputes.

Realistic Expectations

Understand that legitimate investments offer realistic returns that are aligned with market rates. If an investment promises returns that seem too good to be true, they probably are.

Conclusion

The rise of fraudulent financial and land schemes in Kenya highlights the need for greater financial literacy and caution among investors. While the promise of quick money is alluring, it is often a mirage that leads to financial ruin. By taking the necessary precautions and seeking professional advice, Kenyans can protect themselves from falling prey to these scams and ensure that their hard-earned money is invested safely and wisely.

What's Your Reaction?