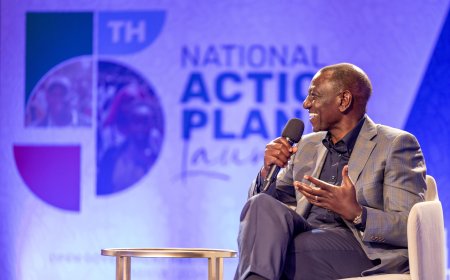

Machakos Governor Wavinya Ndeti Faces Senate Over Missing Millions and Unlawful Accounts

In a recent Senate committee hearing, Machakos Governor Wavinya Ndeti faced tough questions on county finances and governance practices. The hearing highlighted key issues, from streamlining payments to transparency in financial oversight, putting a spotlight on the current administration's handling of public funds. Here’s a breakdown of the main issues discussed and what it could mean for the future of Machakos County.

Governor Ndeti revealed her administration’s steps to simplify county payments by consolidating multiple pay bill accounts into just two. Previously, Machakos County had over 200 pay bill accounts, but these have now been reduced to two primary accounts: one for hospital collections (16161) and another for all other county services (16160). Governor Ndeti explained that this move is meant to improve transparency and make it easier to monitor funds across different sectors of the county.

One of the main areas of concern was the large number of bank accounts held by the county. The Senate questioned why Machakos had 35 active accounts outside the County Revenue Fund (CRF). In response, Ndeti’s administration clarified that 23 of these accounts are specifically for health facilities, while 12 cater to other county functions. Some accounts are also used to manage donor funds. While these accounts help in handling contributions effectively, the Senate questioned whether this approach aligns with public finance rules.

The committee raised red flags about the county’s recordkeeping practices. According to a report by the Auditor General, Machakos County had 245 undisclosed bank accounts with around 225 million KES that were not reflected in financial records. The Senate also probed missing payment vouchers, particularly for a substantial 25 million KES hospitality expense that lacked proper documentation. Such discrepancies point to a need for stricter internal controls and accurate financial reporting.

Senators expressed concern over potential breaches of the Public Finance Management Act, particularly Regulation 82, which requires county accounts to be held with the Central Bank of Kenya. The audit found that 29 Machakos bank accounts were operating outside this framework. Furthermore, the misclassification of certain expenditures raised suspicions about the possibility of funds being shifted without proper approvals. These findings highlight the importance of adhering to strict guidelines to prevent fund misuse.

READ MORE:

- Machakos County Deputy Governor Demands Action Against Rising Violence in Kenya

-

Warning: Machakos County Launches Crackdown on Bhang Dealers

Responding to these concerns, Governor Wavinya Ndeti assured the Senate of her commitment to making necessary reforms. She acknowledged the gaps in current financial processes and pledged to align the county’s operations with legal standards. Ndeti’s administration has committed to reconciling records and making the finance system more transparent, emphasizing the need for clear documentation and adherence to the law.

The Senate reinforced its zero-tolerance stance on undisclosed accounts and poor recordkeeping, warning that future audits should not encounter missing documents. This call for accountability is a reminder to all counties that they must follow national regulations, or they risk sanctions. Senate members highlighted that compliance with financial guidelines is not optional—it’s necessary for the efficient use of public funds.

The Senate hearing underscores the critical role of transparency in county governance. Governor Ndeti’s promise to reform financial operations in Machakos County is a positive step, but continued scrutiny will be essential to ensure lasting change. For citizens of Machakos and across Kenya, staying informed about these proceedings is crucial. Accountability in county governance not only builds public trust but also ensures that public funds are used effectively to drive county development.

What do you think of Machakos County's financial management? Should counties be held to higher standards? Share your thoughts below, and let’s discuss!

Also Read:

-

MOB JUSTICE GONE WRONG IN MLOLONGO.

-

Warning: Mlolongo Bodaboda Riders Urged to Avoid Dangerous Route

What's Your Reaction?